Being your own boss in a place like Park City is the dream, but that dream can feel distant when it’s time to buy a home. Traditional mortgage lenders often get stuck on tax returns, which rarely show the full picture of an entrepreneur’s success. Your business write-offs, while smart, can make it look like you earn less than you do, creating a major roadblock. This is where a 1099 jumbo loan changes the game. It’s a financing tool designed for the realities of self-employment, using your actual gross income to qualify. This guide will show you exactly how to apply for a 1099 jumbo loan in Park City, turning your hard-earned success into your dream mountain home.

Key Takeaways

- Your Gross Income is Your Greatest Asset: A 1099 jumbo loan uses your gross earnings from 1099 forms to determine your eligibility, bypassing the lower income shown on tax returns after business write-offs. This allows your application to reflect your business’s true cash flow.

- Build a Strong Foundation for Approval: Position yourself for success by maintaining a credit score above 700, preparing for a down payment of at least 20%, and gathering your last two years of 1099s and bank statements in advance.

- Local Expertise is Non-Negotiable: The Park City luxury market has unique financing rules. Working with a mortgage professional who specializes in the area ensures you get tailored advice and access to the right loan programs for high-value properties.

What Is a 1099 Jumbo Loan?

If you’re self-employed and dreaming of a home in Park City, you’ve probably realized the traditional mortgage process wasn’t built for you. That’s where a 1099 Jumbo Loan comes in. Think of it as a specialized home loan designed specifically for entrepreneurs, freelancers, and contract workers. It’s a smart financing tool that helps you qualify for a mortgage even if your income documentation doesn’t fit into the standard W-2 box.

For self-employed people, getting approved for any mortgage can feel like an uphill battle, and jumbo loans are no exception. Lenders want to see a stable, predictable income, which can be tricky to show when you run your own business. A 1099 Jumbo Loan bypasses these typical roadblocks by looking at your income differently. It’s tailored for the realities of being your own boss, giving you a fair shot at securing the financing you need for a high-value property in a competitive market like Park City. This loan acknowledges your true earning power, not just what’s left after business deductions.

How It Differs from a Traditional Mortgage

The biggest difference between a 1099 Jumbo Loan and a traditional mortgage comes down to one thing: how you prove your income. Instead of asking for years of tax returns, which can be a headache for business owners, this loan program uses your 1099-NEC earnings statements. This is a game-changer because your tax returns often don’t tell the whole story. As a savvy business owner, you likely have significant tax write-offs that lower your taxable income. While great for tax season, this can make it look like you earn less than you actually do, making it harder to get approved for the loan you deserve. A 1099 loan looks at your gross earnings before all those deductions.

Your Advantage in the Park City Luxury Market

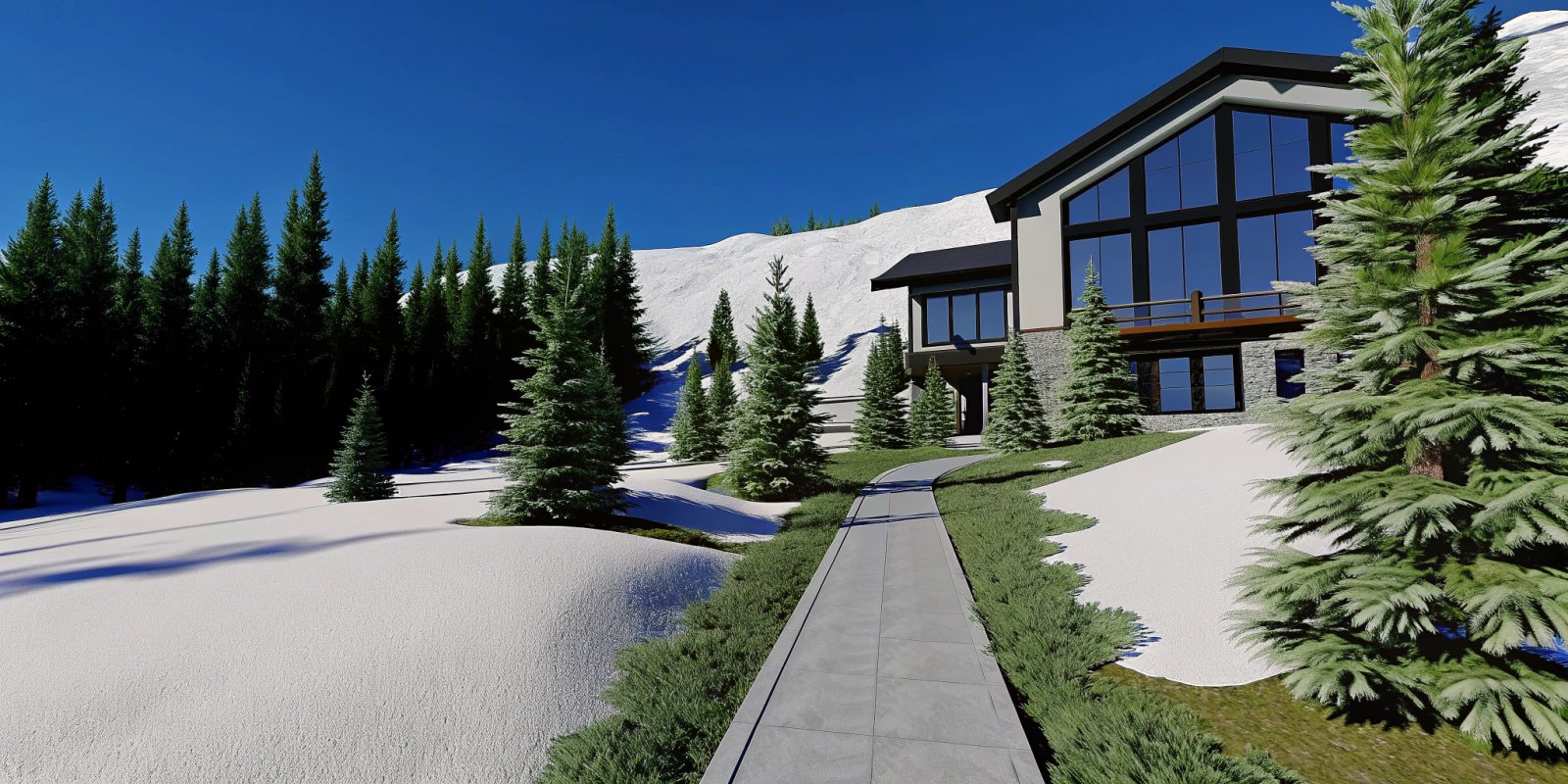

In a place like Park City, where property values are high, jumbo loans are simply the standard for financing a home. The 1099 option gives you, as a self-employed buyer, a powerful advantage. It levels the playing field, allowing your business’s success to be accurately reflected in your mortgage application. And don’t fall for the myth that jumbo loans are only for the super-wealthy. Many successful professionals and business owners with solid, though not extravagant, incomes can qualify for a jumbo loan to purchase a home here. This specialized loan is your key to turning your entrepreneurial success into a beautiful Park City home.

Do You Qualify for a 1099 Jumbo Loan?

Figuring out if you qualify for a jumbo loan when you’re self-employed can feel like a bit of a mystery, but it’s more straightforward than you might think. Lenders who specialize in 1099 loans understand that your income doesn’t fit into a neat W-2 box. Instead of focusing on traditional metrics, they look at the real, consistent income your business generates. Let’s walk through the key benchmarks so you can see exactly where you stand.

Credit and Income Requirements

To get started with a 1099 jumbo loan, lenders are typically looking for a credit score of at least 700. This shows a strong history of managing your finances responsibly. Alongside your credit, you should plan for a down payment of at least 20% of the home’s purchase price. This solid financial footing demonstrates that you’re a reliable borrower ready for a high-value property. Meeting these criteria is the first major step toward securing the financing for your dream home in Park City. You can always explore current mortgage rates to get a better idea of how your down payment will impact your monthly payments.

Key Criteria for Self-Employed Borrowers

Here’s where the 1099 loan really shines for entrepreneurs and freelancers. Instead of digging through years of complex tax returns, which often include deductions that lower your taxable income, lenders focus on your actual earnings. You’ll need to provide your 1099-NEC statements from the last 12 months, plus proof of your current year’s income. This approach gives a much clearer picture of your true cash flow, making it a more logical path to approval for self-employed professionals. This is a core part of how our process works to support independent buyers like you.

Eligible Luxury Properties in Park City

Jumbo loans offer incredible flexibility, which is perfect for the diverse and upscale Park City real estate market. Whether you’re looking for a primary residence in Promontory, a ski-in/ski-out second home in Deer Valley, or a multi-unit investment property in Old Town, a jumbo loan can cover it. These loans are also designed to handle properties that can sometimes be tricky to finance, such as certain condotels or co-ops. This versatility ensures you have the freedom to pursue the exact property that fits your lifestyle, without being limited by conventional financing restrictions.

What Paperwork Will You Need?

Getting your documents in order is one of the most important steps in the mortgage process, especially when you’re self-employed. Think of it less as a chore and more as telling the story of your financial success. When you’re applying for a jumbo loan to buy a beautiful home in Park City, lenders need a clear picture of your income, assets, and overall financial health. Having everything ready from the start makes the entire experience smoother and shows lenders you’re a prepared, reliable borrower.

The main things you’ll need fall into three buckets: proof of your income (your 1099s and tax returns), proof of your assets (bank statements and investments), and other documents that show your business is stable and thriving. It might seem like a lot, but gathering these items ahead of time puts you in a powerful position. We’ll walk through exactly what you need, so you can feel confident and organized as you take this exciting step toward owning your dream Park City property.

Gather Your 1099s and Tax Records

For a self-employed professional, your tax documents are the foundation of your mortgage application. Lenders will want to see your Form 1099-NEC records for the last one to two years. These forms show your gross earnings from each client and are the primary way lenders verify your income without traditional pay stubs. Along with your 1099s, you’ll need to provide your complete personal and business tax returns for the past two years. This history demonstrates a pattern of consistent earnings and gives lenders the confidence that your income is stable and reliable enough to support a jumbo loan.

Prepare Your Bank Statements and Asset Info

Your bank statements provide a real-time look at your cash flow and financial habits. Lenders will typically ask for the last few months of statements for all your accounts, including personal and business. If you haven’t already, it’s a great practice to separate your business and personal finances, as this makes it much easier to show clear, consistent business revenue. In addition to bank statements, you’ll need to document your assets. This includes investment account statements, retirement fund balances, and information on any other properties you own. These assets show you have the reserves for a down payment and closing costs, strengthening your profile as a borrower.

Additional Documents for the Self-Employed

To round out your financial picture, lenders may ask for a few more items that confirm the health of your business. This is your chance to show that your income isn’t just historical but also ongoing. You can do this by providing documents like detailed, paid invoices from clients, signed contracts for future work, or even a letter from your CPA verifying your business’s financial standing. Providing solid proof of income through these documents helps underwriters see the full strength and potential of your business, making your application that much more compelling.

Common Hurdles for Self-Employed Buyers (and How to Clear Them)

If you’re self-employed, you’re used to forging your own path. But when it comes to getting a mortgage, especially a jumbo loan for a Park City property, that independence can feel like a disadvantage. Traditional lenders often struggle to understand an entrepreneur’s income, which can fluctuate and is often reduced by business write-offs. The good news is that these hurdles are completely manageable with the right strategy and a lender who understands the nuances of self-employment.

The key is to work with a mortgage professional who specializes in loans for 1099 earners. Instead of seeing your financial picture as a problem, they see the full story of your success. Let’s walk through some of the most common challenges self-employed buyers face and discuss clear, actionable ways to address them. With the right preparation, you can present a strong application that truly reflects your ability to purchase your dream home in Park City.

Debunking Common 1099 Loan Myths

Let’s clear the air about a few things. First, many self-employed buyers assume they won’t qualify for a jumbo loan or that the process will be impossible. While it’s true that lenders look closely at self-employed applicants, it’s far from impossible. Another myth is that jumbo loans automatically come with sky-high interest rates. In reality, the rates can be quite competitive, especially for a well-qualified buyer. The idea that these loans are only for the ultra-wealthy is also off-base; what matters most is a consistent income history and a solid financial profile, not just a certain job title. Acknowledging the unique challenges is the first step to overcoming them.

Solving the Income Verification Puzzle

This is the biggest challenge for most 1099 earners: proving your income. On paper, your tax returns might show a modest income after all your business deductions and write-offs. A traditional lender might stop right there. However, a 1099 loan program is designed specifically for you. Instead of focusing on your tax returns, we can use your 1099 forms from the last 12 to 24 months to verify your gross income before deductions. This gives a much more accurate picture of your actual cash flow. To prepare, you’ll want to have at least two years of experience in your field and organized records of your recent earnings. This alternative approach makes all the difference.

Proven Ways to Strengthen Your Application

Beyond income verification, there are several things you can do to make your jumbo loan application as strong as possible. First, focus on your cash reserves. Lenders want to see that you have enough liquid assets to cover between six and 12 months of mortgage payments after closing. This demonstrates financial stability and reduces risk. Second, maintain a high credit score and a low debt-to-income ratio. Finally, having all your documentation—like bank statements, asset information, and business records—organized and ready to go shows you’re a serious and prepared buyer. Working with a local expert who can guide you through these steps is the most effective way to present a compelling case to underwriters.

How to Apply for Your Park City Jumbo Loan

Once you’ve gathered your documents and strengthened your application, you’re ready to take the next step. The application process for a jumbo loan in Park City has a few key stages, from understanding local down payment requirements to partnering with the right expert who can guide you to the finish line. Knowing what to expect will help you feel confident and prepared as you move forward.

Down Payments and Loan Limits in Summit County

In Summit County, the jumbo loan landscape has its own set of rules. The standard loan limit is $832,750. Loans between that amount and $1,089,300 are considered “High Balance,” and you might only need a 5% down payment for these. For loans that go above that threshold, lenders typically look for a down payment between 10% and 25%. The exact percentage depends on factors like your credit score, the type of property you’re buying (like a primary residence versus an investment condo), and the specific loan program you choose. Having a clear picture of your potential down payment helps you plan your finances effectively.

A Step-by-Step Application Process

Applying for a jumbo loan involves a thorough look at your financial health. You’ll need to provide standard documents like pay stubs, W-2s, and bank statements. Since you’re self-employed, the focus will be on your 1099s and at least two years of personal and business tax returns. This paperwork gives lenders a complete picture of your income stability and ability to manage the loan. Our team simplifies this by giving you a clear checklist of what’s needed, making the documentation phase feel straightforward and organized. You can see an overview of how it works to get a better sense of the entire journey.

The Importance of a Local Mortgage Pro

Choosing the right lender is one of the most critical decisions you’ll make. When you’re dealing with Park City’s unique luxury market, you need more than just a loan officer—you need a local specialist. A mortgage professional who lives and breathes Park City jumbo loans understands the nuances of financing everything from a ski-in/ski-out cabin in Deer Valley to a modern home in Promontory. We provide that deep local expertise, offering tailored advice and access to a variety of jumbo loan programs designed for your specific situation. This partnership ensures a smoother, more transparent process from pre-approval to closing.

Frequently Asked Questions

Why is using my 1099s a better way to show my income than using my tax returns? Your tax returns are designed to show the lowest possible taxable income by including all your business deductions and write-offs. While this is a smart strategy for tax purposes, it can make it look like you earn less than you actually do when applying for a mortgage. A 1099 loan program looks at your gross earnings before those deductions, giving lenders a much more accurate and favorable view of your true cash flow and ability to afford the home you want.

My income as a business owner isn’t the same every single month. Will that be a problem? Not at all. This is a very common reality for self-employed professionals, and lenders who specialize in 1099 loans completely understand it. Instead of focusing on month-to-month fluctuations, they will look at your income over a 12 to 24-month period. This allows them to see a stable average and a consistent pattern of success, rather than penalizing you for the natural ups and downs of running a business.

Are the interest rates for 1099 jumbo loans a lot higher than for traditional loans? This is a common myth, but the rates are often very competitive. While every borrower’s situation is unique, a strong application with a good credit score, a solid down payment, and documented income history will give you access to favorable rates. The key is to work with a mortgage professional who has established relationships with lenders that offer these specialized programs for self-employed buyers.

Can I use a 1099 jumbo loan to buy a second home or an investment property in Park City? Yes, absolutely. These loans are designed with the flexibility needed for a market like Park City. They can be used to finance a primary residence, a ski-in/ski-out vacation home for your family, or an investment condo you plan to rent out. The versatility of the program ensures you can pursue the property that best fits your financial goals and lifestyle.

Besides the down payment, how much cash should I have saved? Lenders want to see that you have sufficient cash reserves, which are liquid funds available after you’ve paid your down payment and closing costs. A good rule of thumb is to have enough money to cover between six and twelve months of your total monthly mortgage payment. This demonstrates financial stability and shows the lender you can comfortably manage your payments, even if your business has a slower period.